Any business organization objective is to achieve maximum profit. The ways by which this can be achieved are subjected to an approach they use to increase efficiency and decrease wastage and loss. However, some organisations are not willing to pay for some of the facilities, this sluggish approach to update their mode of functioning causes even greater loss.

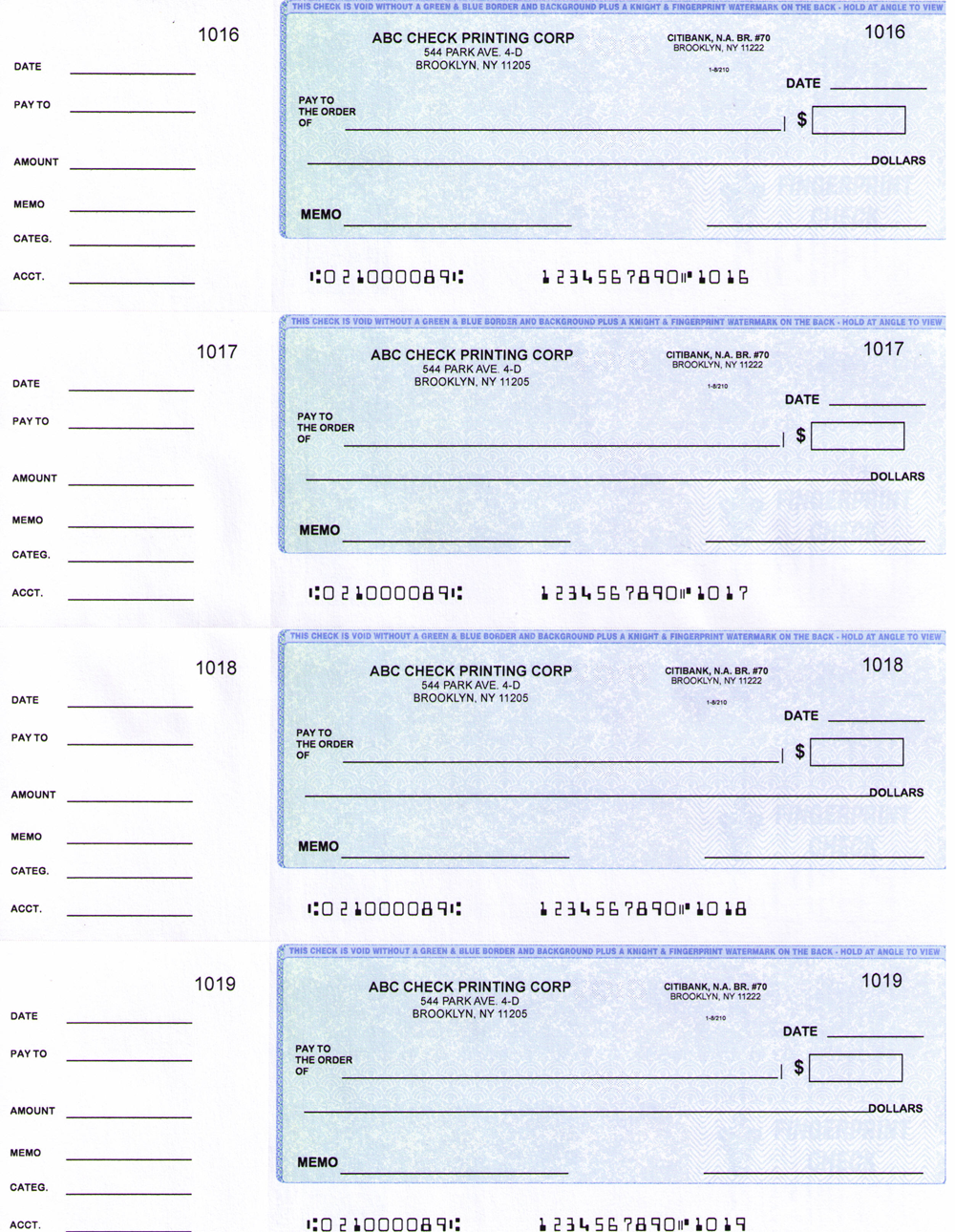

One of the minor change that an organisation can do is by investing in business checks.

This article will give you sufficient reasons to rely on the business check and the impact they can have on your long-term profitability.

Smooth management of financial activities

Managing requirements of different financial instruments for daily business affairs can be tiring and time consuming. In such circumstances of competitiveness if an organization diverts its time and manpower in secondary activities it may result in degrading performance in the primary field for which organisation is meant to be. Here business checks be extensively useful as hiring some reliable dealer who can sort out the supply requirements of financial instruments and categorically work according to various needs.

Compatibility and proficiency

Any business organisation deals with multiple and multilayered financial transactions. These transactions vary from intra-business to inter-business financial exchange, expenses and supplies. As such is the entangled scenario for any business when it comes to dealing with such numbers of financial activities. Here hiring an expert for managing affair will require a proven compatibility and proficiency. The movement a business organisation chooses a supplier with suitable compatibility and proficiency these two qualities also reflects the performance of your business.

Minimising errors and reducing risks

Financial errors often results in increasing risk. Using business checks minimises errors and reduces the possibilities of a breakdown of structural balance in financial activities. Business laser checks are developed to work in symbiosis with accounting software being used by the organization. This symbiosis eases the task of bookkeeping and also secures the data of financial transactions which is not there when managed by business organizations alone.

Time is Money

Bejanmin Franklin, in an essay Advice to a Young Tradesman, rightly said that ‘ Time is Money’. Your business growth is constrained by various factors such as availability of resources, the nature of communication and transportation used and the methods of functioned applied. These constraints can be removed or overcome by using new technologies and further division and simplification of the task to expert available in commerce. So if your organization does not value time than it can be the case that it loses out all the possibilities to convert valuable time spent on maintenance of vouchers required for the business, payroll, and general expense. A decisive result in the increase in profitability can be achieved if your organisation opt for the business check.

So, with above-mentioned advantages of business checks it can be concluded that business checks have the potential instrumentality to provide you your ultimate desired end of increasing profitability with simultaneously resulting in increased efficiency.